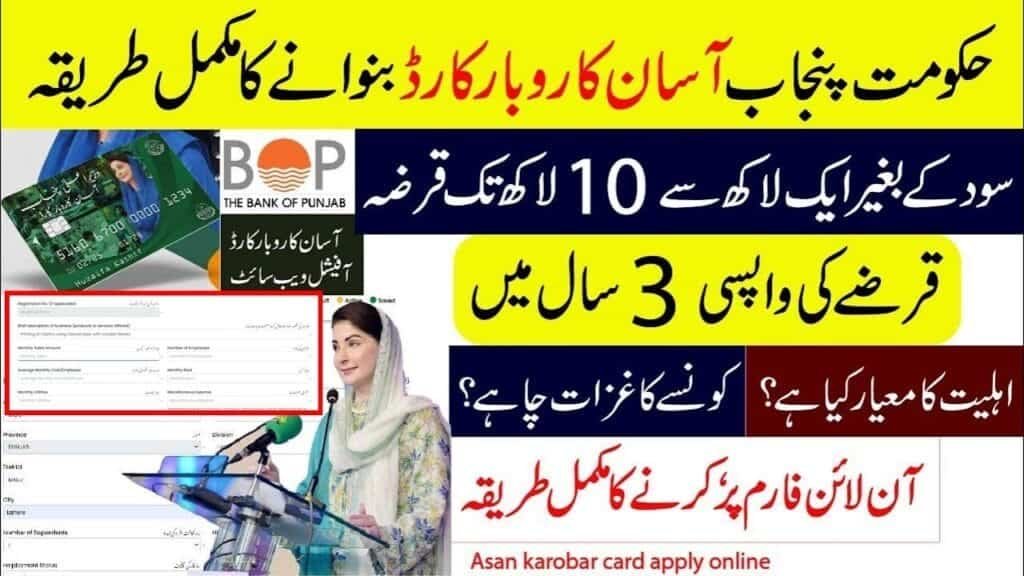

If you’re a small business owner in Punjab, Pakistan, looking for easy financing, the Asaan Karobar Card Loan and Asaan Karobar Finance Loan could be the perfect solutions for you. The Punjab government has introduced these initiatives to support entrepreneurs, boost local businesses, and drive economic growth. In this guide, we’ll cover everything you need to know about these loan programs, including benefits, eligibility, and how to apply.

What is the Asaan Karobar Card Loan?

The Asaan Karobar Card Loan is a financial assistance program launched by the Punjab government to provide easy and quick loans to small business owners, freelancers, and startups. With this loan, entrepreneurs can access hassle-free financing without excessive paperwork or long waiting periods.

Key Features:

- Loan Limit: Up to PKR 2 million

- Low Markup Rate: Government-subsidized rates to make repayment easier

- Flexible Repayment Plans: Ranging from 1 to 5 years

- Collateral-Free Loans: No need for heavy security deposits for smaller loans

- Quick Processing: Faster approval process compared to traditional bank loans

What is the Asaan Karobar Finance Loan?

The Asaan Karobar Finance Loan is another initiative under this program, specifically designed to provide structured financial support to growing businesses. This loan helps entrepreneurs invest in new equipment, expand their operations, and improve cash flow management.

Check out the latest Muft Atta Scheme 2025 for more government initiatives.

Key Features:

- Higher Loan Limits: Up to PKR 5 million for eligible businesses

- Government-Backed: Ensures lower risk and better terms

- Startup & SME Support: Ideal for both new and existing businesses

- Business Expansion Focus: Helps in purchasing machinery, stock, or expanding premises

Who Can Apply?

Both of these loan programs are targeted at small business owners, self-employed individuals, and startups in Punjab. To qualify, you typically need to meet the following criteria:

- Age: Between 21 to 60 years

- Business Type: Must be registered or in active operation

- Residency: Must be a resident of Punjab, Pakistan

- Creditworthiness: Good financial track record preferred

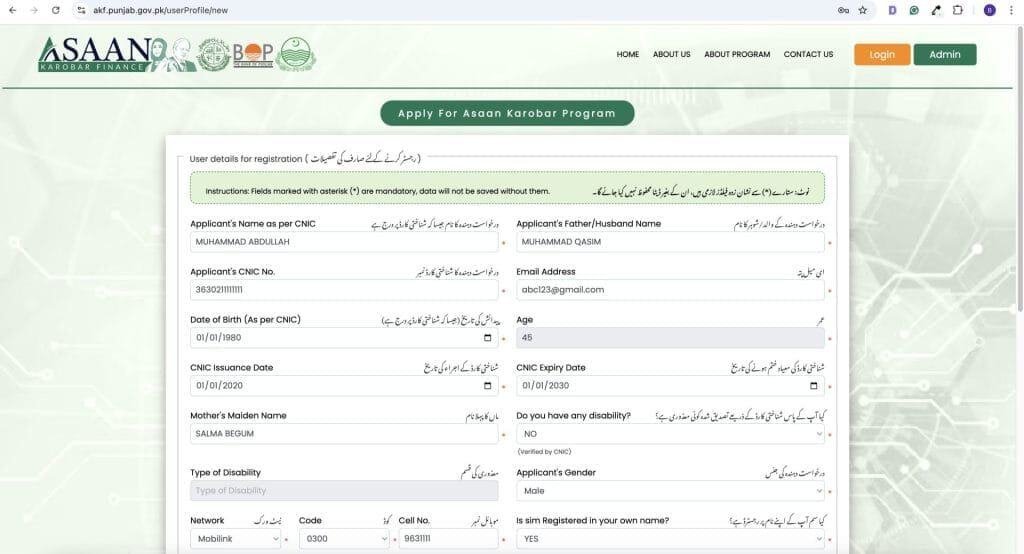

How to Apply for the Asaan Karobar Loan?

Applying for the Asaan Karobar Card Loan or Asaan Karobar Finance Loan is simple. Here’s a step-by-step guide to get started:

Step 1: Gather Your Documents

Before applying, make sure you have:

- CNIC (National ID Card)

- Proof of Business Registration (if applicable)

- Bank Statements (last 6 months)

- Tax Documents (if required)

Step 2: Visit the Official Website or Bank

- Check the Punjab government’s official website or visit a participating bank offering these loans.

- Look for the online application form and fill in your details correctly.

Step 3: Submit Your Application

- Attach the required documents and submit your application.

- You may need to visit the bank for verification.

Step 4: Loan Approval & Disbursement

- Once approved, funds will be transferred to your business account.

- You can use the loan amount for working capital, inventory, or business expansion.

Why Choose the Asaan Karobar Loan?

Here’s why this initiative is a game-changer for Punjab’s business community:

- Government Support: Backed by the Punjab government, ensuring credibility and ease of access.

- Fast Processing: No long delays; get funds quickly to grow your business.

- Flexible Terms: Tailored repayment plans to suit your financial situation.

- Boosts Local Economy: Helps small businesses thrive, creating jobs and economic stability.

Frequently Asked Questions (FAQs)

1. Can I apply if my business is new?

Yes! Startups are encouraged to apply as long as they meet the eligibility criteria.

2. Is there any markup or interest on these loans?

Yes, but the rates are subsidised by the Punjab government, making them lower than commercial bank loans.

3. How long does it take for approval?

Typically, approvals take between 7 to 15 working days, depending on verification.

4. What happens if I miss a payment?

Late payments may result in penalties. It’s best to communicate with the bank if you face any issues.

Final Thoughts

The Asaan Karobar Card Loan and Asaan Karobar Finance Loan are incredible opportunities for business owners in Punjab. Whether you’re launching a startup or expanding an existing business,. These government-backed loans offer affordable, accessible, and easy financing options. Don’t miss out—apply today and take your business to the next level!