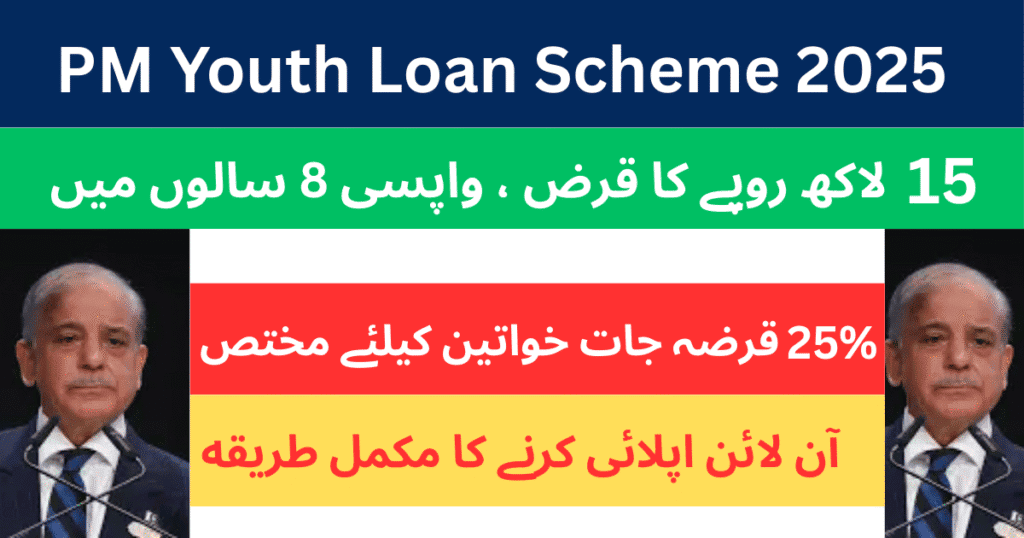

The Government of Pakistan has once again brought good news for the youth in 2025. If you have a business idea or want to grow your small business but don’t have enough money, the PM Youth Loan Scheme 2025) is made for you.

یوتھ لون اسکیم 2025 حکومتِ پاکستان کا ایک زبردست قدم ہے جو خاص طور پر بے روزگار نوجوانوں کی مدد کے لیے شروع کیا گیا ہے۔ اس پروگرام کا مقصد نوجوانوں کو کاروبار شروع کرنے یا موجودہ کاروبار کو بڑھانے کے لیے آسان قرض فراہم کرنا ہے تاکہ وہ خود کفیل بن سکیں۔ اس اسکیم سے وہ تمام پاکستانی نوجوان فائدہ اٹھا سکتے ہیں جن کے پاس کوئی کاروباری آئیڈیا ہے لیکن مالی وسائل کی کمی ہے

This scheme is specially designed to help young people, especially those who are jobless, to stand on their feet. You can apply for a loan of up to Rs. 75 lakh with easy monthly installments.

Also Read : CM Punjab Laptop Program 2025: Don’t Miss This Golden Opportunity!

What Is PM Youth Loan Scheme 2025?

It’s a loan scheme launched by the government where young people can get money to start or expand their businesses. You don’t need to be highly educated to apply — even if you studied till primary or middle, you can still apply.

The best part? For the first 6 months, you don’t need to pay anything back, and you can return the full loan in up to 8 years.

Loan Amounts and Interest Rates

The scheme is divided into 3 categories:

| Tier | Loan Amount | Interest Rate |

|---|---|---|

| Tier 1 | Up to Rs. 5 lakh | 0% (No interest) |

| Tier 2 | Rs. 5 lakh – Rs. 15 lakh | 5% per year |

| Tier 3 | Rs. 15 lakh – Rs. 75 lakh | 7% per year |

Most people go for Tier 2 loans, especially if they need money to grow an existing business or start something new on a small scale.

Who Can Apply?

✅ You are eligible if:

- You are a Pakistani citizen with a valid CNIC

- Your age is between 21 to 45 years (or 18+ if applying for IT or e-commerce)

- You want to start or grow a business

❌ You can’t apply if:

- You are a government employee

- You are living abroad (overseas Pakistanis who are not residents)

Which Banks Are Giving the Loan?

These banks are part of the scheme:

- Bank of Punjab (BOP)

- National Bank of Pakistan (NBP)

- Askari Bank

- HBL

- Bank of Khyber

Most people prefer BOP, NBP, and Askari Bank because they are faster and easier to deal with.

How To Apply for PM Youth Loan Scheme 2025 (Step-by-Step)

- Go to the official website:

👉 https://pmyp.gov.pk - Use the loan calculator (optional but helpful)

It will show you how much you will pay every month, total markup, and total repayment amount. 💡 Example: If you take Rs. 10 lakh for 8 years in Tier 2, you’ll pay around Rs. 12,660 per month after the 6-month grace period. - Start your application

Click on “Apply for Loan” and fill in your details:

- CNIC number and date

- Choose your tier (e.g., Tier 2 for Rs. 5 to 15 lakh)

- Give your business idea

- Upload documents (CNIC photo, basic business info)

- Select the bank you want to apply through

Important Tips Before You Apply

- ✔️ Make sure your CNIC is valid

- ✔️ Think of a simple and clear business idea

- ✔️ Choose a bank with a good name and easy process

- ✔️ Be honest while filling the form

- ✔️ Double-check all information before you submit

How to Track Your Application?

After applying, you can check the status by clicking “Track Application” on the website. Just enter your CNIC and mobile number.

Final Thoughts

This scheme is a golden chance for anyone in Pakistan who wants to do something on their own but doesn’t have the money. Whether you want to start a shop, run a food stall, open an online store, or grow your existing business — this loan can make your dreams possible.

Take your first step today. Plan properly, apply smartly, and build your future with confidence.

FAQs – People Also Ask

Q: Do I need to give any collateral (zaminat)?

A: Maybe. It depends on how much loan you are taking and which bank you choose.

Q: Can students apply?

A: Yes, if you are above the minimum age and have a good business idea.

Q: Can someone with a running business apply?

A: Yes, the scheme is also for people who want to grow their current business.